They pleasure themselves with the understanding how its mother or father company’s framework timelines really works so that your domestic (and) financing stay on agenda.

It indicates you happen to be able to get your hands on the lowest mortgage rate you to definitely outside lenders just cannot defeat.

Continue reading for more information on them to know if it was a good fit to suit your financial requires.

Encourage Mortgage brokers Offers Huge Rate Buydowns

- Direct-to-individual mortgage lender

- Offers household purchase fund

- Oriented from inside the 2016, based during the Newport Seashore, Ca

- An entirely had subsidiary out-of Century Organizations

- Mother company is in public areas replaced (NYSE: CCS)

- Authorized to help you give during the 18 claims across the nation

- Funded throughout the $dos mil in home loans in the 2022

- Really energetic when you look at the California, Tx, Georgia, and you can Tx

- In addition to operates a concept providers and insurance company

Promote Lenders is a completely had part out-of Century Groups, which gives to help you-be-oriented and you may quick disperse-inside the property within the some says all over the country.

Their number one notice offers household buy financing to people out-of newly-situated homes on of many organizations it services on country.

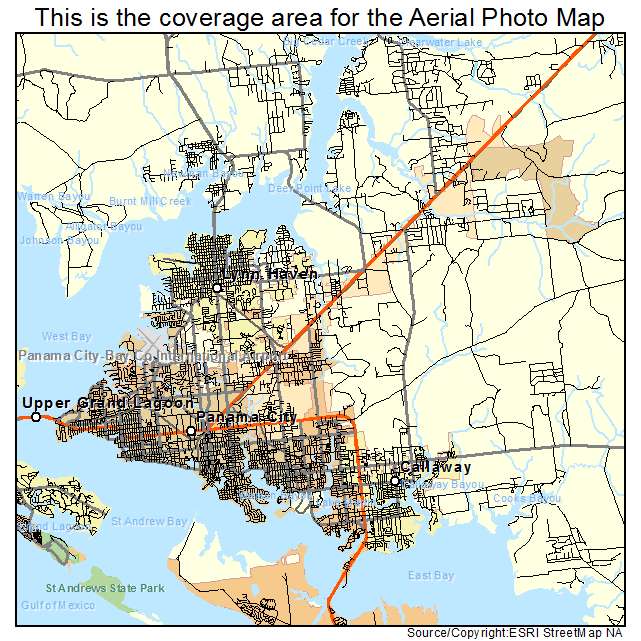

They are licensed from inside the 18 claims, as well as Alabama, Washington, Ca, Colorado, Florida, Georgia, Indiana, Louisiana, Kentucky, Michigan, Vegas, New york, Ohio, South carolina, Tennessee, Colorado, Utah, and you can Washington.

Just like other builder-connected lenders, Promote Home loans plus operates a subject insurance and payment organization titled Parkway Term, and you will an insurance company named IHL Home insurance Service.

It indicates you certainly can do one to-end finding all of your current mortgage demands, whether or not it certainly is wise to buy around for this type of third-team features as well.

How to get started

You can either visit an excellent Century Communities brand new home transformation work environment to locate matched up with a loan manager, or simply look online.

For people who go to their website, you might simply click Pre-qualify Today to gain access to a loan manager index you to definitely directories the countless organizations manage by the its father or mother organization.

After trying to find a state, you can easily look for a community to determine what mortgage officers suffice that certain development.

After that, you’ll see email address and you may have the ability to score pre-qualified for a home loan or visit if you have currently used.

Its digital application for the loan is running on fintech providers nCino. It allows that eSign disclosures, hook up monetary accounts, and finish the app out-of one equipment.

You may also slim in your devoted, human financing class that is available to assist and supply answers when you provides questions.

They appear supply a good equilibrium off one another technical and you may individual reach to make you the conclusion line.

And since he is connected to the brand new builder, they will be able to express freely and sustain your loan to your tune predicated on build position.

Financing Apps Considering

With regards to mortgage choice, they’ve the significant loan software property consumer you may you need, and compliant funds, jumbo funds, together with full assortment of authorities-recognized fund.

The newest Ascent Club

This might include understanding how to conserve to own an advance payment, how to get advantage supplies, just how to boost fico scores, as well as replace your DTI proportion.

And you may whether you’re a first-date home buyer or veteran, they run free webinars to respond to people mortgage questions click this over here now you may want to features.

Promote Mortgage brokers Prices and you will Costs

They won’t listing their financial rates otherwise lender fees online, which isn’t atypical. But I do offer loan providers kudos after they carry out. It’s a bonus out of an openness standpoint.

So we have no idea just how aggressive he or she is in line with almost every other lenders, nor can we know if it charges that loan origination percentage, underwriting and you may operating charges, application payment, and stuff like that.

Definitely inquire about every charge once you first talk about mortgage cost which have an interest rate officer.

Once you get a speed price, you to definitely and the financial costs accounts for the home loan Annual percentage rate, that is a definitely better cure for examine mortgage can cost you out-of bank in order to lender.

An example offered a two/step 1 buydown to 3.5% to the first 12 months, 4.5% in the season a few, and 5.5% repaired toward kept twenty-eight years.

That is rather tough to defeat when home loan cost was near to eight.5 now%. This will be one of several great things about utilising the builder’s home loan company.

However, as always, make sure to store your price together with other loan providers, credit unions, lenders, etc.

Convince Lenders Evaluations

But not, he has got a 1.8/5 to the Yelp from around 29 feedback, though the sample size is without a doubt slightly small. At the Redfin he’s a better 4.4/5 out of 7 analysis, and that once more is actually a little try.

You may also browse its personal workplaces on nation into the Google observe critiques because of the location. This can be even more of good use if you work with a particular regional office.

The father or mother team have an enthusiastic A+’ get into Better business bureau (BBB) site and has now already been licensed given that 2015.

In spite of the solid page grade get, obtained a negative step one.05/5-celebrity get according to more than 100 customers product reviews. This may pertain to their several issues filed more than many years.

Make sure you take care to read through a few of these to find out how of many relate to their financing office in place of their new home-building unit.

Obviously, it’s likely that while using Convince Home loans to acquire a financial, you are also to invest in good Century Teams possessions.

So you can sum one thing upwards, Motivate Lenders provides the most recent tech, a variety of mortgage applications, and can even bring pricing deals you to external lenders can’t take on.

He has specific blended product reviews, but generally positive of them, even though your own distance may differ according to whom you work on.

However, take care to store third-group loan providers, brokers, banking companies, etc. Along with other now offers available, you could discuss and you may possibly house an even greatest bargain.