Even if you have only 1 or 2 employees, you must pay your share of payroll taxes on wages paid to those employees. In some industries, worker compensation insurance is a significant expense for the employer and therefore we consider it an important part of payroll accounting. Keeping track of your organization’s spending is fundamental to managing resources successfully. Using the accrual method, you record both the wages payable obligation (payroll liability) and expenses in the same period.

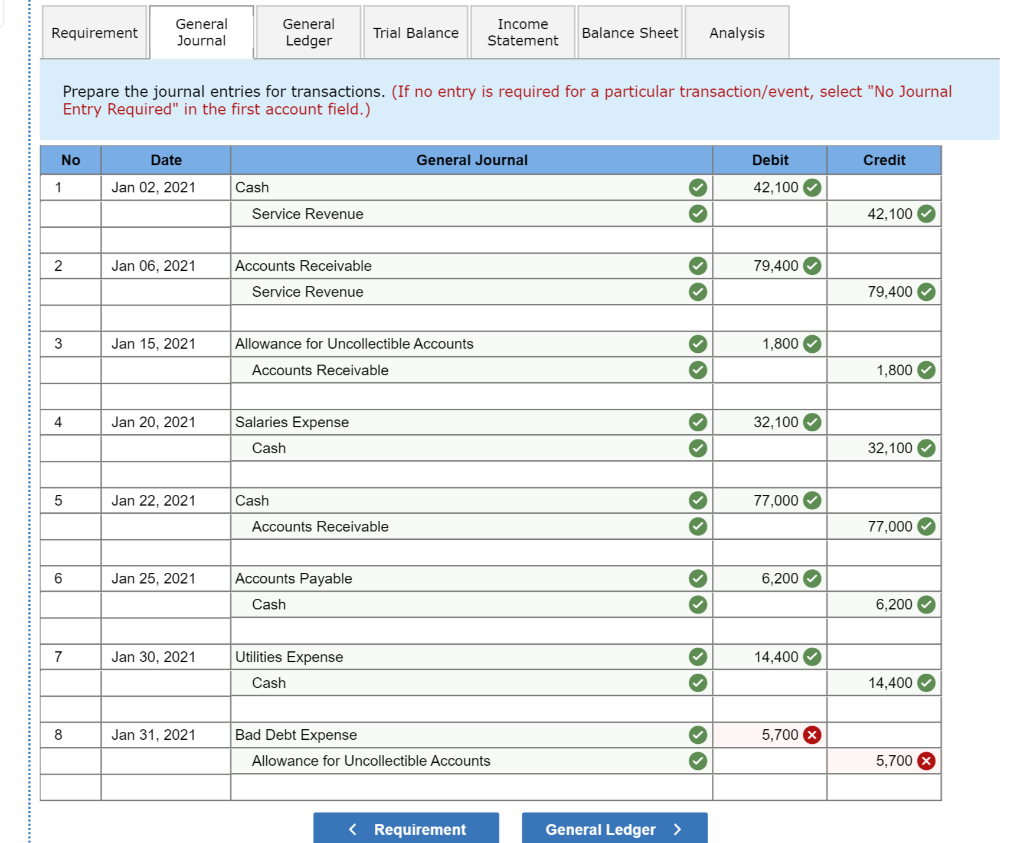

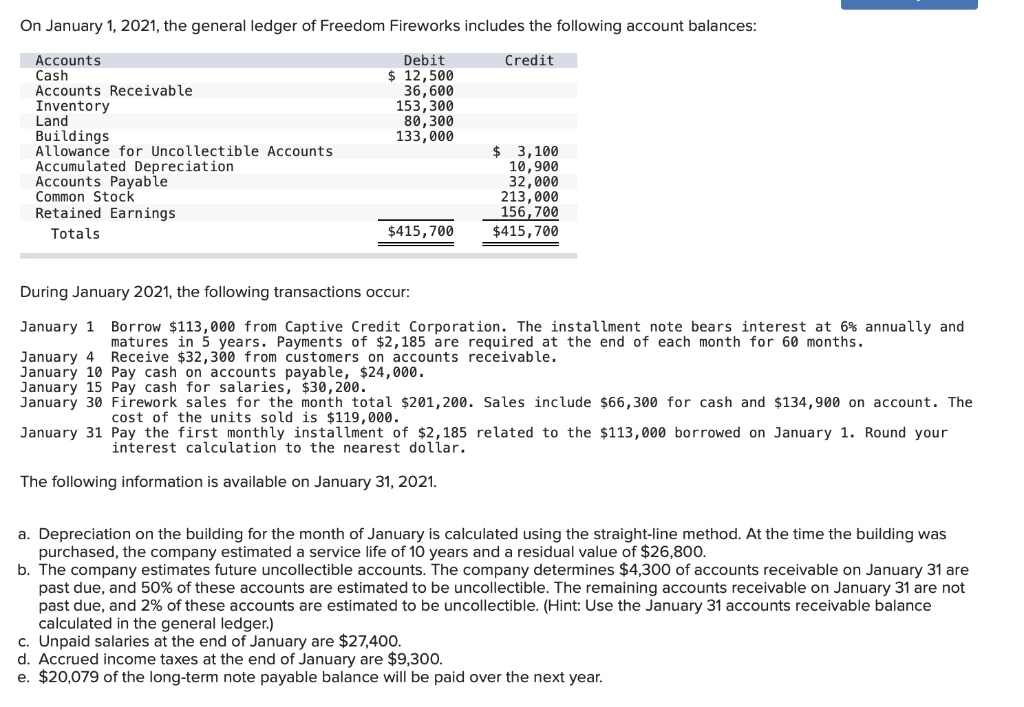

An employee’s cost is their gross annual pay and yearly payroll taxes plus any other expenses that you pay on their behalf (retirement contributions, insurance, etc.). This item is any money paid by the employer or organization to the government as taxes every year. Major kinds of taxes would be state income taxes, federal income taxes, state unemployment taxes, federal unemployment taxes, or taxes for health insurance or other premiums. A payroll journal entry is a tracked account of all the payroll expenses being divvied out in the form of salaries and other payroll-related items. These financial entries are included in the organization’s financial statements through the general ledger, helping to streamline the storing of everything to do with employee wages and more.

Manage payroll expenses

But prices have doubled or tripled since the pandemic amid high material and labor costs and she worries that she won’t recoup her investment when she sells her three-bedroom house. By contrast, the Federal Reserve Bank of San Francisco recently figured that a paltry $190 billion or so was left as of June and that sum likely would be exhausted by the Top Bookkeeping Services for Nonprofit Companies July-September quarter. Agency officials are reworking the number based on the government revisions and wouldn’t comment. Even so, the cash buffer could run out in a few months, according to their most recent analysis. Daco reckons $1.3 trillion is still left while Mark Zandi, chief economist of Moody’s Analytics, puts the figure at $1.8 trillion.

Overall, the amount of federal income tax ranges from 10% to 37% of their taxable income. To calculate payroll, identify employee wages, complete essential paperwork, calculate gross pay and deductions, set up charts of accounts and pay taxes. To automate the entire process, you can get a payroll system to get everything done in less time. Paying independent contractors or freelancers is usually more simple than paying employees. You will pay them based on the terms agreed upon, but you do not need to collect taxes or other deductions for these workers. Contractors handle their own payroll, meaning they’re responsible for filing and paying payroll taxes.

Important Payroll Terms to Know

Most often, you will pay federal taxes when you pay Social Security and Medicare taxes. Once you have taken out pre-tax deductions, the remaining pay is taxed. The FICA tax rate is 7.65%—1.45% for Medicare and 6.2% for Social Security taxes. Other tax rates will be determined by Federal, state, or local laws and your employee’s W-4. This is where you deduct withholding taxes and benefits withholdings from gross employee pay.

Don’t forget that you can continue to apply for scholarships during this time to score additional gift aid for school. There’s no specific deadline to apply for a private student loan, but you want to make sure you get the funds in time for school. Some lenders can approve and disburse a private student loan in just a couple of weeks, while others may take up to two months. But the stimulus money is long gone and the resumption of student loan repayments this fall will saddle her with another $500 monthly expense, she estimates. Be cautious in retaining team members who repeatedly make mistakes. One of my clients terminated a team member for making a similar mistake repeatedly.

Learn How NetSuite Can Streamline Your Business

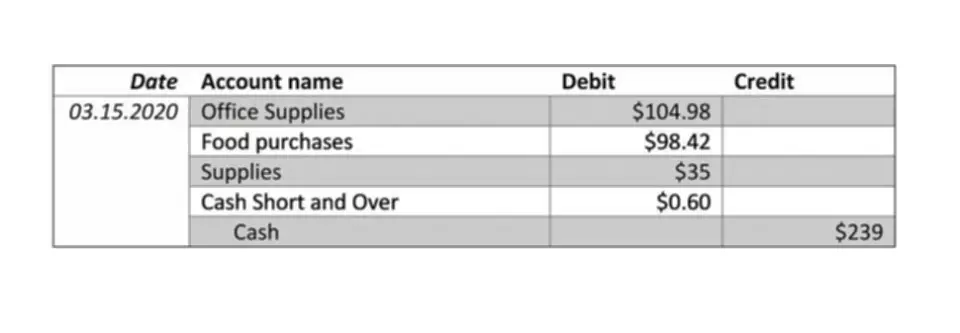

While most employees choose to receive their earnings through direct deposits into their bank accounts, some people still prefer to receive a paper check. No matter which method they prefer, https://www.wave-accounting.net/fund-accounting-101-basics-unique-approach-for/ make sure you provide them with a physical or electronic pay stub for their records. An employer may have both liabilities and expenses for the same employee, due to paid time off.

- You’re “accruing” these expenses even though they haven’t physically been covered yet, as accrual happens at the end of some accounting periods.

- For example, you may withhold amounts for the employee’s share of insurance premiums or their retirement contributions.

- If you change your HR software, see if it integrates with different payroll software.

- You pay unemployment taxes, both federal and state (if applicable), separately from the taxes shown in Journal 2 and Journal 3.